Quickbooks for Shopify Sellers: Is DIY Worth it? Bench Accounting

Content

Download the extensive 54-page guide on how to spend less than an hour on your accounting and bookkeeping every month. Webgility’s Shopify integration can connect your QuickBooks Online or Desktop account to your Shopify store to simplify operations overall. When you connect the two platforms, you won’t have to switch between your Shopify store and your QuickBooks file and manually enter information. Epic Mens sells a variety of brands hand-selected for superior design and quality. But first, they needed to connect their online storefronts and back-end operations.

As always, if you need help with your Shopify accounting, reach out to us. Our goal with this article is to give you a comprehensive understanding of the things you should consider, along with various methods, so you can decide on what is best for you. Once you’ve decided, this guide also helps you execute the method you’ve chosen. Enroll today to get instant, lifetime access to the Shopify Bookkeeping Method. Discover the essentials and workflows to take on Shopify bookkeeping like a pro.

Digitise your accounting with a cloud-based accounting software

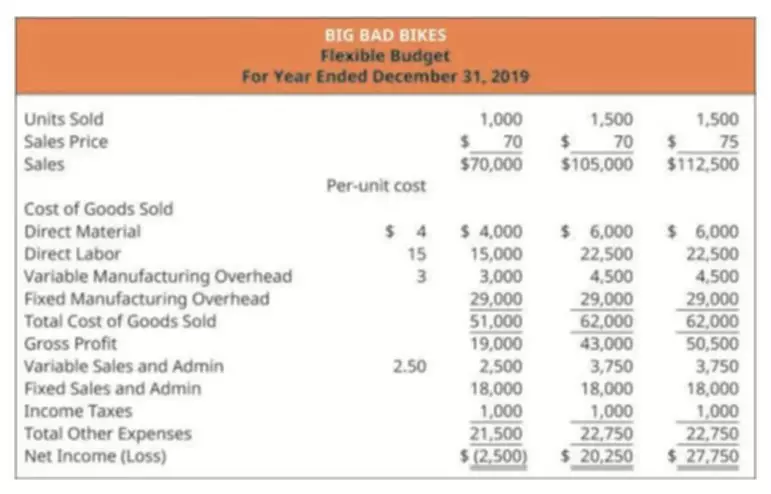

Analysing financial statements is often outsourced to an accountant but there are a few basics that are useful for Shopify store owners to understand. Your cloud-based accounting software will be able to generate financial statements automatically. Key reports that you’ll want to understand include your balance sheet, income statement and cash flow statement. Ecommerce accounting presents multiple challenges, including the need to track goods across multiple warehouses for efficient inventory management. Another complex aspect involves managing sales tax liability across various jurisdictions under “economic nexus†rules.

- If you adhere to these five steps to streamline your Shopify bookkeeping, you’ll be able to focus your time and resources towards running your business.

- Greenback will refresh your settings from QuickBooks and search for possible matches/duplicate transactions.

- Determining when an ecommerce seller must charge sales tax is complex, as different states have different rules.

- It’s also beneficial for businesses that want to use QuickBooks to analyze sales trends on a transaction level.

- This workflow creates a transaction any time a sale is made on Shopify.

- Most small to medium businesses use the cash basis because it’s less work.

Having a specialist ecommerce accountant for your business can be invaluable, particularly if you have automated your books. By automating them, you have access to instant, up-to-date records and reports – so use them. Sales tax is a huge topic that heavily depends on what you sell, where and how. For this bookkeeping for shopify reason, we have dedicated guides to help you better understand everything below. Proper bookkeeping gives a company or business trustworthy information regarding their progress. Therefore, even before having a big team and many employees, it is essential to invest in keeping records of everything.

The Best Way To Do Your eBay Bookkeeping Using A2X

Moreover, accurate records can prevent errors, penalties, and audits, providing peace of mind to the store owner. If you don’t have bookkeeping experience, Shopify accounting will take a lot of your time. Online store owners worry about default reports, fraud prevention, financial reports, and more. The only way to move forward with your business is to know where you currently stand financially.

Does Shopify do QuickBooks?

If you're using QuickBooks Desktop accounting software, then you can integrate your QuickBooks Desktop app account with your Shopify POS. This action syncs all your business and accounting data, such as sales and purchases, to your accounting system.

Shopify transactions do calculate sales taxes, so paying attention to your accounting helps you understand when to remit to maintain tax compliance. You didn’t start your ecommerce business so you could juggle accounts and balance books. You started it to sell products, serve customers, and make money while you’re at it. But ecommerce bookkeeping is a necessary and important part of keeping your accounts in good shape. To transfer sales data from your selling platform to your bookkeeping system, you need a reliable integration.

Get your taxes right

For expenses like your monthly subscription plans, “netted” out card swipe fees, and other costs, Greenback creates ancillary transactions if needed. As mentioned in Step 3, best practice is to treat them as “Operating Expenses” and lump them together as Merchant Fees. For an example on how to handle an export, here’s a similar video working with Stripe expenses. This course is for anyone who is doing the ecommerce accounting using Xero or QuickBooks Online for a company using Shopify for their website sales. Before you implement this method, make sure you have set up your chart of accounts using this video.

The best way to do so is to integrate accounting software into the ecommerce platform. We are experts in both accrual and cash basis accounting methods and we are happy to follow whichever method you prefer. Given our expertise within eCommerce and Shopify, we have seen that the majority of eCommerce companies use the accrual based bookkeeping method.

Monitor cash flow

One of the significant advantages of using accounting software for your Shopify business is the seamless integration between the two platforms. Dedicated accounting software like QuickBooks Online or Xero often directly integrates with Shopify. This integration automatically synchronizes data, including sales, expenses, and customer information, between your e-commerce store and your accounting system. For sales, ensure that every Shopify order is logged in your accounting software, including details like product name, price, customer information, and date of purchase. Automating this process can save time and reduce the risk of manual errors. Effective accounting for Shopify enables store owners to precisely monitor their sales, expenses, and profitability.

If the cash flow is positive, you have a financially healthy business. Accrual accounting is an accounting technique that records transactions when they are incurred or earned rather than when cash is exchanged. QuickBooks is likely the most familiar name in business accounting software, and for good reason. It’s a Shopify-ready solution designed for small and mid-sized businesses across various industry verticals and business needs. Greenback learns the correct export settings and mappings as you do them. So you’ll only need to export a few different types of transactions (e.g. sales receipt, a monthly subscription fee, refund) and Greenback will begin to pick the right defaults every time.

Fortunately, syncing data from your Shopify store to your accounting software can now be done in a matter of a few clicks. An accounting integration can automate the process of recording sales and payments data, categorising them, and reconciling bank statements. The first step is integrating your Shopify store with your accounting software and A2X to ensure data is shared between them automatically. Then, you’ll need to categorize your income and expenses by setting up your chart of accounts and tax mappings. With just a few clicks, you can access comprehensive reports such as profit and loss statements, balance sheets, and cash flow statements. These reports offer a snapshot of your business’s financial health, enabling you to identify trends, track performance against targets, and make data-driven decisions.

- Because of how sales taxes must be tracked state-by-state, even smaller operations have complex bookkeeping needs when they sell in a new state.

- One of the significant advantages of using accounting software for your Shopify business is the seamless integration between the two platforms.

- To charge the correct sales tax rate for each type of product and area you sell to, you should find an effective Shopify accounting software.

- Automating this process can save time and reduce the risk of manual errors.

Tracking the amount, location, and pricing of available inventory can be a real headache. Compare A2X, Taxomate, and Link My Books for e-commerce bookkeeping. Discover seamless integration, automation, user-friendly, and worry free accounting.

What are the most common mistakes in ecommerce bookkeeping?

Lots of Shopify sellers gravitate to Intuit QuickBooks (or QuickBooks Online) to handle their accounting needs. We’ll cover how to use QuickBooks as a Shopify seller and whether a hands off approach is a better fit for your business. One of the biggest mistakes a Shopify store owner can make is neglecting bookkeeping.

You can also connect your bank account and credit cards to Shopify. Sometimes business owners focus on materials, products, and shipping only. But it’s essential to keep track of expenses like rent, utilities, property tax, salaries, insurance, and loan payments. Perhaps one of the most challenging tasks of ecommerce companies is inventory management. With proper bookkeeping you can ensure you have enough items in the inventory.

With features such as automated tax management, smart revenue matching, and trend analysis, QuickBooks Online simplifies your financial management. As a result, effective cash flow management allows for better financial stability, enabling businesses to weather uncertainties and seize growth opportunities. Scott Scharf is the Co-Founder and Chief Ecommerce Geek of Catching Clouds LLC. Scott is passionate about helping business owners run better businesses by having detailed, accurate financials so they can make great decisions. Scott loves talking to and consulting with ecommerce sellers by reviewing their technology stack, internal operations, cloud inventory, and sales tax management. Reconciling your bank statements with your Shopify data is a critical task ensuring your financial records’ accuracy and integrity.